Are you eager to cruise in the car of your dreams? We understand that a dream car is more than just transportation; it's an expression of your taste. That's why we offer a selection of auto loan choices to aid you secure the perfect wheels for your goals.

- Competitive interest rates

- Adjustable payment plans

- Swift approval process

Don't permit your dream car remain a aspiration. Reach out to our auto loan experts today and take the first step toward driving your dream.

Secure an Affordable Auto Loan Today

Are you hoping of driving a new vehicle? Don't let financing be a barrier. We offer favorable interest rates and flexible payment to make your car ownership a reality. With our simple application process, you can qualify for an auto loan today!

- Explore our wide selection of loan options

- Speak to one of our knowledgeable loan officers

- Start your application online or in person today!

Obtain Auto Loans: Drive Away with Confidence

Securing an auto loan can appear daunting, but it doesn't have to be. With a little preparation, you can navigate the process smoothly and find the ideal financing solution for your needs. Lending institutions offer a selection of loan programs, so you can opt one that satisfies your budget and financial goals.

Before you request for an auto loan, compile the necessary documents, such as proof of income, your debt history, and contact information. Grasping your rating is also crucial, as it can affect the interest rate you'll be offered.

- Contrast rates from different lenders to confirm you're getting the most favorable terms.

- Review the loan agreement meticulously before signing. Familiarize yourself with the interest rate, repayment duration, and any fees involved.

- Preserve a good credit history to improve your chances of acceptance.

Searching for Perfect Auto Loan to Match Your Budget

Buying a car is an exciting endeavor, but it's important to plan out your financing options. A favorable auto loan can make the process seamless, allowing you to drive away in your dream vehicle without spending a fortune.

When it comes to securing an auto loan, there are various factors to keep in mind. First and foremost, you'll want to determine your budget. How much can you comfortably manage each month? Once you have a solid understanding of your financial limits, you can start shopping around.

Researching different lenders and their interest rates is essential. Don't just accept the first offer you receive. Take your time to analyze multiple loan terms and conditions to find the most suitable option for your needs.

Remember, a good auto loan should match your budget and financial goals. With a little effort, you can secure an auto loan that will assist you in achieving your automotive dreams.

Expedite Your Auto Purchase with a Pre-Approved Loan

Buying a new vehicle should be an exciting journey, not a stressful ordeal. One way to ensure a smooth process is by obtaining a pre-approved loan before you even walk into a dealership. This puts you in a strong negotiating position and enables to focus on finding the perfect car for your needs without the strain of financing.

With a pre-approved loan, you already know how much you can borrow, giving you a clear financial plan. You'll also have a better understanding of your monthly payments, making it easier to formulate a realistic budget for your car expenses. Dealerships are more prone to work with you when they know you're pre-approved, as it shows that you're a serious and reliable buyer.

In short, a pre-approved loan can greatly simplify the car buying process. It empowers you with awareness, saves you time and worry, and ultimately puts you read more in control of your automotive acquisition.

Delve into Competitive Auto Loan Rates and Terms

Securing an auto loan can be a crucial step when purchasing a new or used vehicle. With numerous lenders offering varied loan options, it's essential to meticulously compare rates and terms to obtain the most favorable deal.

Start your search by comparing quotes from multiple lenders, comprising banks, credit unions, and online lending platforms. Pay close attention to the annual percentage rate (APR), loan term, and any included fees.

Consider your monetary situation when determining a loan that meets your needs. A lower APR will result in diminished overall interest payments, while a shorter loan term may lead to increased monthly payments but minimal interest paid over time.

Ultimately, securing the best auto loan involves researching your options and making the terms that optimize your financial health.

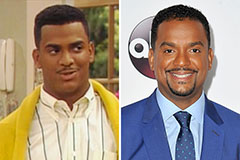

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!